Product Introduction

The digitization of payments has introduced new methods such as Mobile Money and QR code, which create complex interconnections and

clearing requirements that traditional bank card switching networks cannot address. From a national financial infrastructure perspective,

it is crucial to develop a dedicated clearing network system specifically for electronic payments.

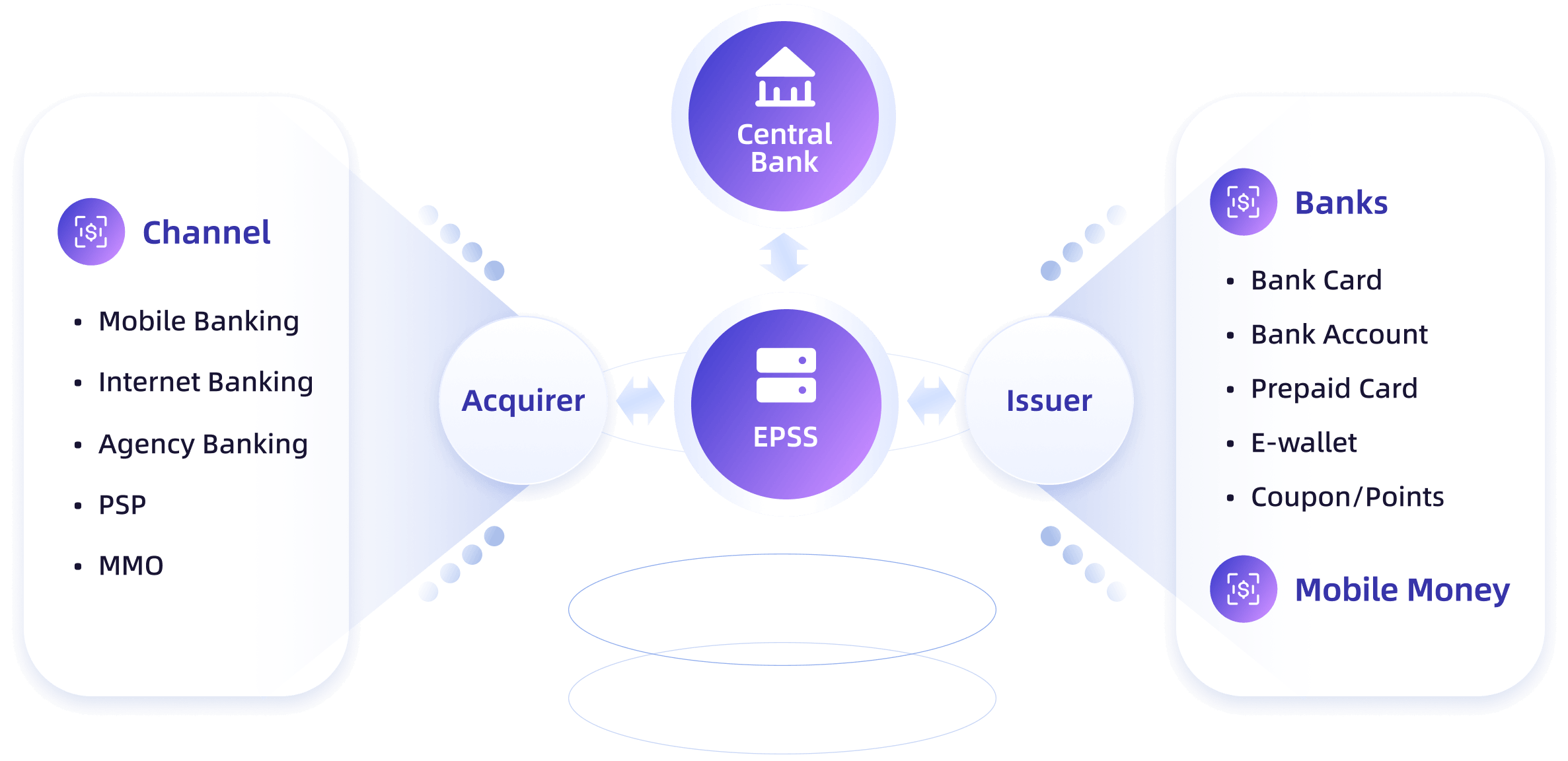

The MuRong Electronic Payment Switch System (EPSS) is a digital payment switch solution that handles transaction switching,

clearing and settlement, dispute resolution, risk management, and value-added services. Acting as a robust infrastructure,

it effectively connects banks, payment service providers (PSPs), mobile money operators (MMOs), and other participants,

fostering seamless collaboration within the digital ecosystem.

This comprehensive system ensures smooth transactions while significantly improving the overall customer experience.

EPSS Scenarios

EPSS SCENARIOS

Inclusive Finance

E-KYC for segment customer verification;

No cash based on E-wallet;

Cardless based on digital account;

Digital operation support all services;

Business Agility

TTM decreased significantly;

Digital finance ecosystem could be built with new partners easy and quickly;

360° customer review provide unified growth plan and experience for customer;

Customer Acquisition

Customer acquisition cost reduction based on precision marketing;

Open platform is easy to get customers from its ecosystem;

Hi-technical System

Reduce cost of software and hardware;

Improvement of system carrying capacity;

Easy parameterization and configuration based on distributed and micro service design.

Our

Product

Features

Standard Interface with All Participants

EPSS integrates a range of access specifications into a unified framework, leveraging an open platform to achieve seamless integration.

Unified Dispute and Arbitration Capabilities

EPSS has an independent dispute resolution system that provides a unified approach to handling disputes across various business modules.

Differentiated Pricing

EPSS employs a diversified pricing strategy that allows for flexible pricing based on the differences among participants.

International Data Exchange Protocols

EPSS is designed with a strong focus on internationalization, fully embracing international standard data specifications. eg. ISO8583, ISO20022, etc.

Real-time Clearing and Settlement

Offers real-time clearing and real-time settlement functionalities, enabling swift and efficient transaction processing.

Active-Active with 7*24 Service

EPSS supporting dual-active and three-center deployment methods across two locations. Seamless support for 7x24 hours service.

Unified Risk Control and Anti-fraud

EPSS has a unified and independent risk control and anti-money laundering (AML) system. Through data analysis and model-based predictions, it ensures the security and integrity of its business operations.

High Security to Safeguard the Transactions

EPSS meets PCI-DSS standards, ensuring transaction security and data storage safety.

Our Product Benefits

Reduce Access

Difficulty

Reduce Access Difficulty

Unified Access System and Robust Risk Control of EPSS Lowers Barriers for SMEs to Participate in Financial Markets, Enhancing Competitiveness.

Improve Operational

Efficiency

Improve Operational Efficiency

EPSS has unified specifications, which solves the complex docking problems of multi-participant and multi-standard systems and improves the operational efficiency of the payment market.

Promote

Digital Payment

Promote Digital Payment

Supports Multi-Channel and Diversified Payment Tools, Drives Digital Payments to Meet Varied Socioeconomic Needs.

Reduce

Costs

Reduce Costs

The use of the advance architecture with open-source software can significantly reduce the infrastructure costs and the IT operation & maintenance costs. The easy and quick integration can also save the costs for participants.

Strengthen

Regulatory

Strengthen Regulatory

The transactions are process within the country and the data are kept in country which can strengthen the regulatory for payment & settlement to safeguard and defuse financial risks in the field of payment and maintain financial security.

Efficient

Operation

Efficient Operation

EPSS provides the automated process which can improve the operation efficiency for system owner and participants.

Our

Product

values

National paymet system

Connects the national money market, bond market, foreign exchange market and other financial markets.

The core infrastructure of national economy and finance Prevent.

Promote the improvement of digital finance efficiency.

Strengthen public confidence.

National market economy

The key layout to solve the existing financial problems of the various of industries.

Promote the long-term and healthy development of the market.

Resolve the imbalance of market competition.

The efficiency and security of economic operation is required by economic subjects.

Globalization and Reform

Higher requirements for cross-border payment.

Rapid development of Foreign exchange clearing.

Prevent the outflow of illegal funds.

Promote the development of nationalFDI.

National payment supervision

Curb illegal and criminal acts due tothe cashless transaction.

National stability Serving monetary policy.

Financial stability Anti moneylaundering.

Anti terrorist financing Anti corruption and anti tax evasion.