MuRong IDO is committed to helping banks build an omni-channel digital banking system. It enables seamless integration with mainstream core banking systems worldwide, allowing banks to quickly establish a new generation digital business platform while maintaining continuity of existing operations. Proven in practice, MuRong IDO significantly improves customer experience and reduces operational complexity. It is particularly suitable for banking institutions that need to ensure stable core system operations while accelerating digital transformation. Built on a distributed microservices architecture, MuRong IDO meets banks' multidimensional needs, from infrastructure upgrades to product innovation, and ensures future scalability of the technology.

MuRong IDO offers banks a balanced path to digital transformation,

ensuring both speed and continuity.

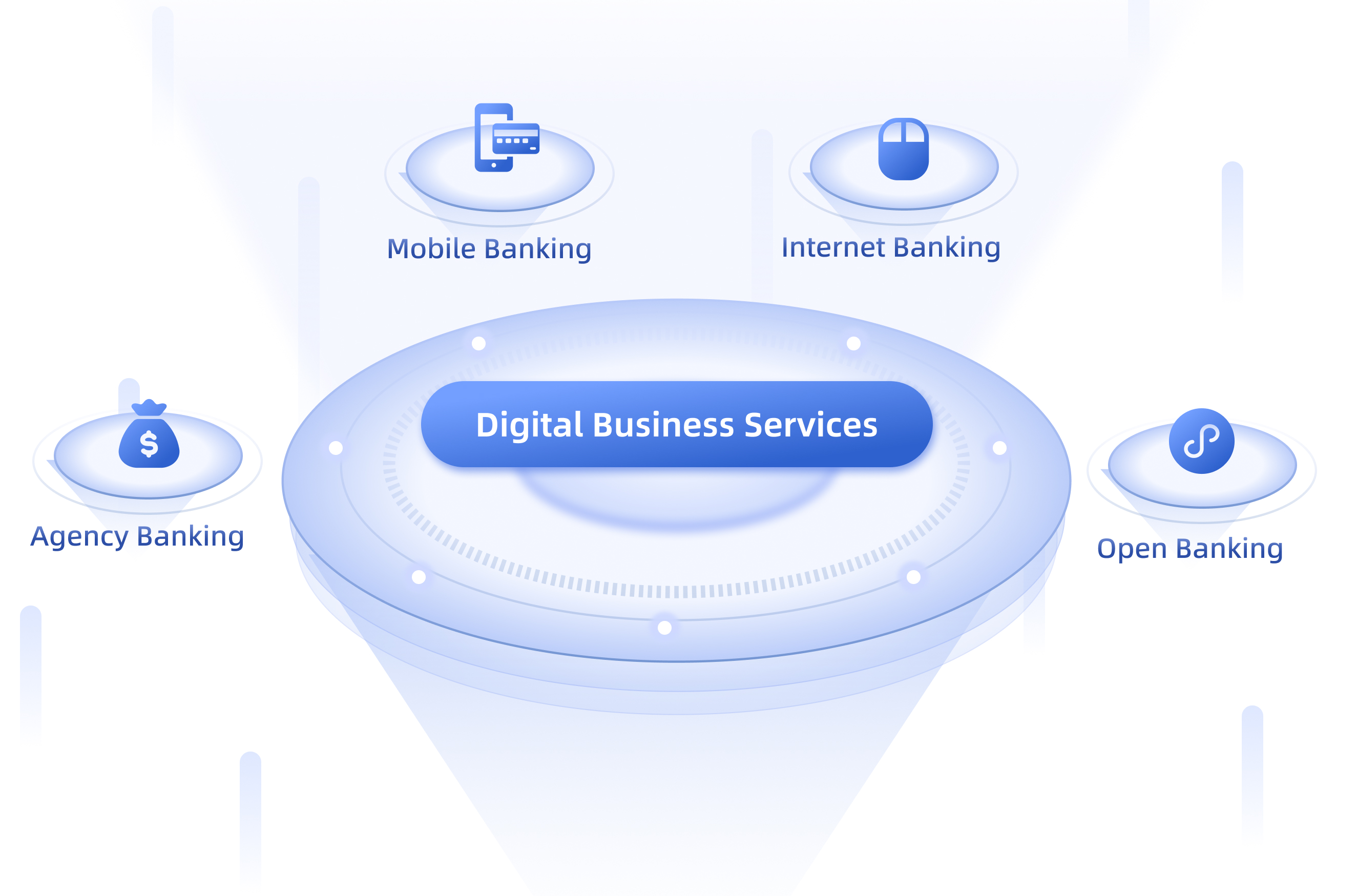

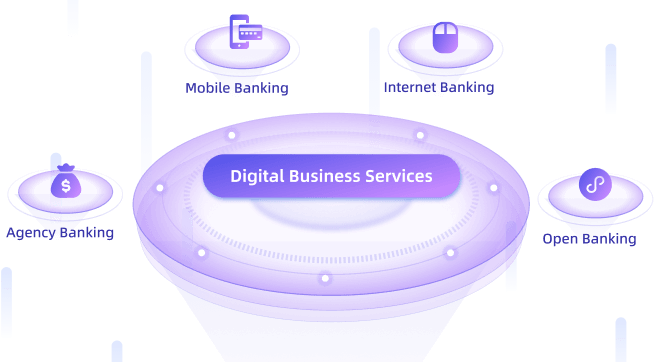

It offers comprehensive digital business service capabilities.

Commercial banks can flexibly select and customize them according to their own needs,

effectively reducing operational costs and improving return on investment.

MuRong IDO aggregates digital business capabilities to provide reusable and scalable technical

and business components.

It supports rapid product innovation and agile iteration,

and delivers an omni-channel service experience to customers.

MuRong IDO is committed to helping banks build an omni-channel digital banking system. It enables seamless integration with mainstream core banking systems worldwide, allowing banks to quickly establish a new generation digital business platform while maintaining continuity of existing operations. Proven in practice, MuRong IDO significantly improves customer experience and reduces operational complexity. It is particularly suitable for banking institutions that need to ensure stable core system operations while accelerating digital transformation. Built on a distributed microservices architecture, MuRong IDO meets banks' multidimensional needs, from infrastructure upgrades to product innovation, and ensures future scalability of the technology.

MuRong IDO offers banks a balanced path to digital transformation,

ensuring both speed and continuity.

It offers comprehensive digital business service capabilities.

Commercial banks can flexibly select and customize them according to their own needs,

effectively reducing operational costs and improving return on investment.

MuRong IDO aggregates digital business capabilities to provide reusable and scalable technical

and business components.

It supports rapid product innovation and agile iteration,

and delivers an omni-channel service experience to customers.

Of MuRong

IDO

MuRong IDO

Omni-Channel Experience

Personalized Services

Efficient Origination

Rapid Product Launch

AI-Powered

Layered Security

Secure and Convenient Onboarding

Enhanced Innovation Components

Benefits

Accelerate Digital Transformation

Exceptional user experience

Accelerate the Open Ecosystem

Low-Cost Operation

Reduce Total Cost of Ownership (TCO)

Future-Proof Technical Architecture

Real Results

As the commercial bank with the largest asset scale in East Africa, KCB has successfully completed its digital transformation through "MuRong IDO". It has realized integration with its existing core banking system and rapidly launched a digital banking system, which supports KCB's digital financial business and customer services in six countries: Kenya, Tanzania, Burundi, South Sudan, Rwanda, and Uganda. Based on this, KCB has actively expanded inclusive financial services and further explored market cooperation, covering multiple industries such as insurance, retail, e-commerce, and government. This has significantly improved customer experience and service coverage, setting a model case for the digital transformation of large commercial banks.

Since 2019, China Construction Bank has collaborated with Murong Technology to implement a series of secure, flexible, and open digital banking systems, actively advancing online financial business. By 2024, the system has launched over 200 digital financial products, serving more than 100 large industry clients and over 80,000 merchants, covering dozens of industries including e-commerce, new retail, automobiles, and government. During peak periods such as "618" and "Double 11", it has achieved tens of thousands of transactions per second with zero failures throughout the process, and the cumulative transaction volume has exceeded RMB 480 billion. It has fully helped CCB improve customer experience, reduce operational costs, and maintain a leading edge in the digital finance field.

Oman Arab Bank (OAB), a leading and innovative commercial bank in Oman, boasts a comprehensive business portfolio covering retail banking, corporate banking, Islamic finance, etc, and has always taken business expansion and digital innovation as its core objectives. Through cooperation with MuRong Tech, OAB has built a new multi-channel digital service system, achieved the modernization upgrade of technical architecture and digital innovation of products, reshaped customer journeys, promoted digital transformation, and established itself as an industry benchmark in West Asia.

As a large national commercial bank in China, Bohai Bank urgently needs to accelerate the construction of open banking and the layout of industry ecosystems to cope with the increasingly fierce market competition. To this end, Bohai Bank has joined hands with MuRong Tech and successfully implemented a comprehensive upgrade of its digital banking system and open platform using MuRong IDO. After the upgrade, Bohai Bank can carry out in-depth cooperation with external partners (such as financial institutions, e-commerce, retail, catering, government services, etc.) through an efficient, lightweight, and low-cost cooperation model, providing customers with integrated financial services and further strengthening its core competitiveness in inclusive finance and cross-industry financial scenarios.

As Kenya’s largest microfinance institution, Faulu has long been committed to providing inclusive financial services to individuals and small and medium-sized micro-enterprises. In the process of promoting the implementation of inclusive finance, digital banking business has become a key support. For this reason, after a comprehensive and prudent evaluation, Faulu ultimately chose MuRong IDO to enhance system performance and digital business capabilities—not only enabling the flexible launch of new products and providing customers with an omni-channel service experience, but also possessing the ability to quickly establish external cooperation and efficiently integrate into industry ecosystems. This has laid a solid foundation for Faulu to further expand the inclusive finance market and continuously optimize customer experience.

As one of China’s five major state-owned banks, Bank of Communications has maintained in-depth technical cooperation with MuRong Tech for a long time. Relying on MuRong IDO, it has completed the comprehensive upgrade of open banking systems and mobile banking systems in multiple branches. At the product and service level, Bank of Communications has achieved efficient coverage and continuous innovation of digital business in multiple regions, expanded third-party service integration capabilities, and strengthened ecological cooperation; in terms of customer experience, by simplifying operation processes, improving response performance, and enhancing security authentication, it has significantly lowered the user threshold and improved service convenience and security. In the future, MuRong Tech will continue to assist Bank of Communications in achieving technological innovation and providing customers with better digital financial service experiences.

Results

Real Results

As the commercial bank with the largest asset scale in East Africa, KCB has successfully completed its digital transformation through "MuRong IDO". It has realized integration with its existing core banking system and rapidly launched a digital banking system, which supports KCB's digital financial business and customer services in six countries: Kenya, Tanzania, Burundi, South Sudan, Rwanda, and Uganda. Based on this, KCB has actively expanded inclusive financial services and further explored market cooperation, covering multiple industries such as insurance, retail, e-commerce, and government. This has significantly improved customer experience and service coverage, setting a model case for the digital transformation of large commercial banks.

Since 2019, China Construction Bank has collaborated with Murong Technology to implement a series of secure, flexible, and open digital banking systems, actively advancing online financial business. By 2024, the system has launched over 200 digital financial products, serving more than 100 large industry clients and over 80,000 merchants, covering dozens of industries including e-commerce, new retail, automobiles, and government. During peak periods such as "618" and "Double 11", it has achieved tens of thousands of transactions per second with zero failures throughout the process, and the cumulative transaction volume has exceeded RMB 480 billion. It has fully helped CCB improve customer experience, reduce operational costs, and maintain a leading edge in the digital finance field.

Oman Arab Bank (OAB), a leading and innovative commercial bank in Oman, boasts a comprehensive business portfolio covering retail banking, corporate banking, Islamic finance, etc, and has always taken business expansion and digital innovation as its core objectives. Through cooperation with MuRong Tech, OAB has built a new multi-channel digital service system, achieved the modernization upgrade of technical architecture and digital innovation of products, reshaped customer journeys, promoted digital transformation, and established itself as an industry benchmark in West Asia.

As a large national commercial bank in China, Bohai Bank urgently needs to accelerate the construction of open banking and the layout of industry ecosystems to cope with the increasingly fierce market competition. To this end, Bohai Bank has joined hands with MuRong Tech and successfully implemented a comprehensive upgrade of its digital banking system and open platform using MuRong IDO. After the upgrade, Bohai Bank can carry out in-depth cooperation with external partners (such as financial institutions, e-commerce, retail, catering, government services, etc.) through an efficient, lightweight, and low-cost cooperation model, providing customers with integrated financial services and further strengthening its core competitiveness in inclusive finance and cross-industry financial scenarios.

As Kenya’s largest microfinance institution, Faulu has long been committed to providing inclusive financial services to individuals and small and medium-sized micro-enterprises. In the process of promoting the implementation of inclusive finance, digital banking business has become a key support. For this reason, after a comprehensive and prudent evaluation, Faulu ultimately chose MuRong IDO to enhance system performance and digital business capabilities—not only enabling the flexible launch of new products and providing customers with an omni-channel service experience, but also possessing the ability to quickly establish external cooperation and efficiently integrate into industry ecosystems. This has laid a solid foundation for Faulu to further expand the inclusive finance market and continuously optimize customer experience.

As one of China’s five major state-owned banks, Bank of Communications has maintained in-depth technical cooperation with MuRong Tech for a long time. Relying on MuRong IDO, it has completed the comprehensive upgrade of open banking systems and mobile banking systems in multiple branches. At the product and service level, Bank of Communications has achieved efficient coverage and continuous innovation of digital business in multiple regions, expanded third-party service integration capabilities, and strengthened ecological cooperation; in terms of customer experience, by simplifying operation processes, improving response performance, and enhancing security authentication, it has significantly lowered the user threshold and improved service convenience and security. In the future, MuRong Tech will continue to assist Bank of Communications in achieving technological innovation and providing customers with better digital financial service experiences.