Top 5 commercial bank in China

Bank of Communications(BOCOM), headquarters in Shanghai, is

the 5th largest bank in China with more than 2800 domestic

branches and 23 overseas branches & representative offices. It is one of the oldest banks in China. As of

the end of

2023, its asset size exceeded RMB 14 trillion, with over 190 million customers and over 300 million

accounts. In 2023,

it was selected as a global systemically important bank. Bank of Communications ranks ninth among global

banks by

tier-one captail .

The challenges

BOCOM is currently providing comprehensive financial

services to 2.6192 million corporate customers and 192 million

personal customers. The servicces include deposit, loan, supply chain finance, cash management,

international settlement

and trade finance, investment banking, asset custody, wealth management, bank card, private banking, and

treasury

business.

The scale of these business requests and the massive data processing put the IT system under higher

standards and

greater challenges. The IT system should not only provide fully application support for full business

scenarios in the

present, but also ensure the expansion of future products and services, as well as the rapid upgrade

driven by technical

innovation.

The challenges come from two aspects:

From technology perspective:

Core banking, payment systems, agent business, and channel applications are scattered on different

technical platforms

of branches, which is difficult to plan, upgrade, and maintain

Faced with the requirements of digital transformation

Can BOCOM support agile development models

and build a DevOps platform to comprehensively improve development efficiency

and reduce development costs?

From business perspective:

Can BOCOM promote digital financial innovation with a customer-centric approach?

Can BOCOM provide personalized products, intelligent services, open ecosystems, data-based risk

control, and regulatory

compliance to meet the business requirements of digital transformation?

In summary, in order to cope with the development of business and technical

innovation, it is urgent for bank to

optimize and upgrade its technical systems.

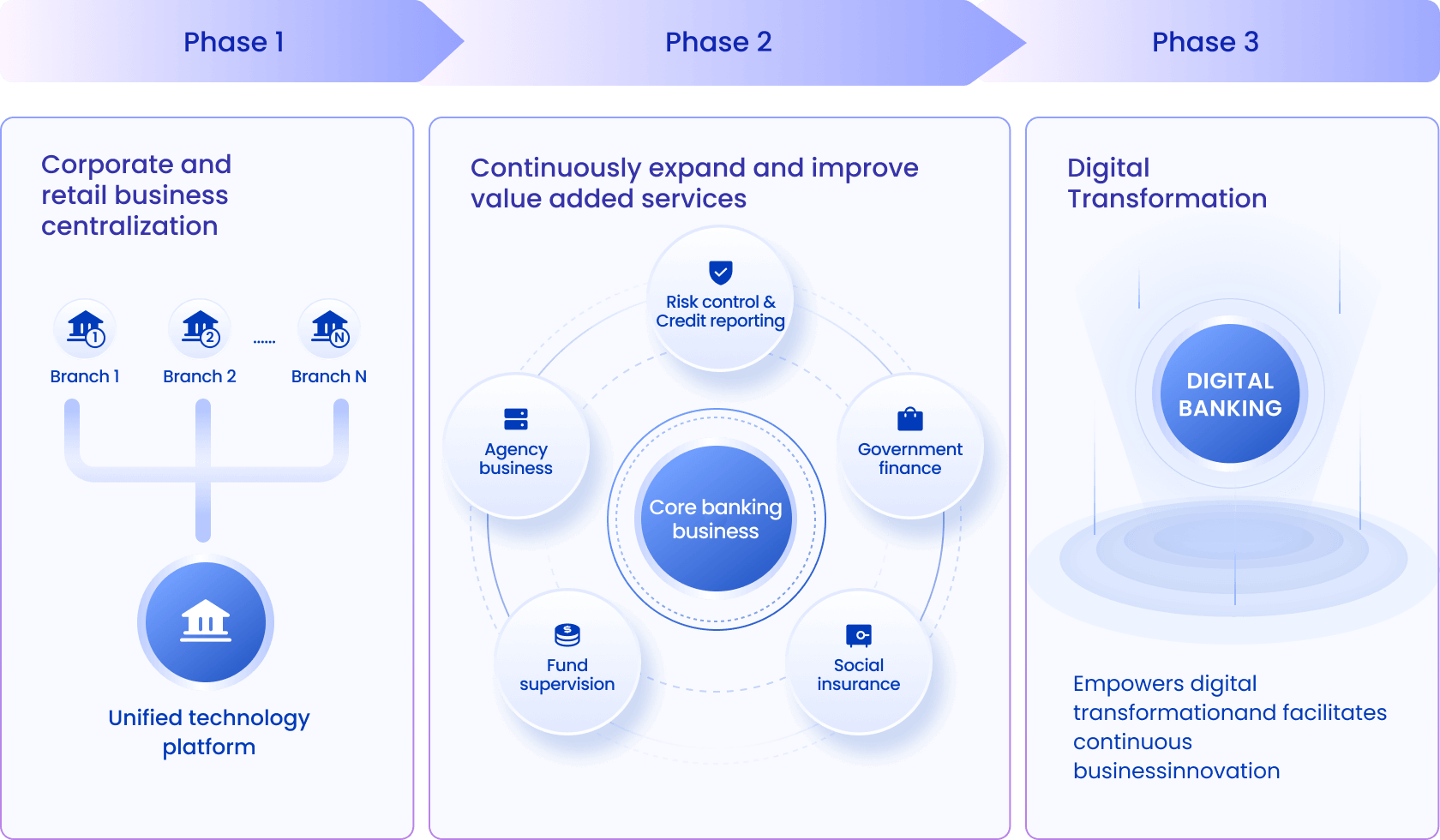

MuRong Solution

Since June 2013, MuRong and Bank of Communications have

started a long-term and in-depth cooperation process around the

upgrading and transformation of IT core systems such as the "core banking" and "digital banking".

During the cooperation, MuRong set up a solution team with deep understanding of the banking and financial

industry and

many years of rich implementation experience. After thorough research and analysis of the customer's core

pain points,

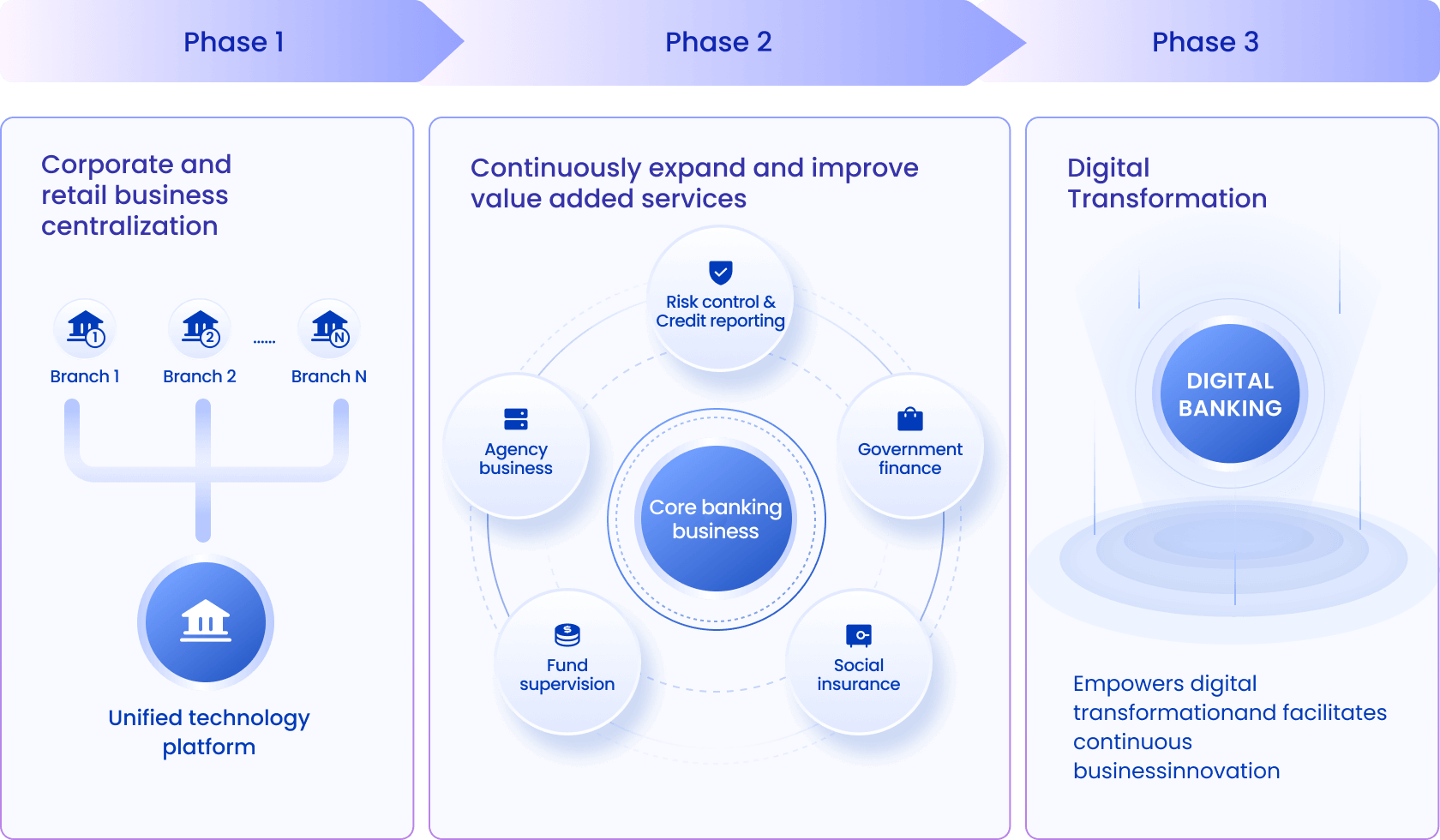

the team customized a "three-step" solution plan for bank.

In the solution, based on MuRong's standardized products,

MuRong customized and deployed the "core banking" and "digital

banking" systems to provide Bank of Communications with a new platform. The platform has a series of

features and

advantages, such as unified standardization, distributed and micro-service architecture, open

extensibility, and

covering comprehensive business applications, which enables Bank of Communications to successfully achieve

standardization and digital transformation. The platform also leverages the technical advantages to

quickly iterate and

upgrade, and continuously expand its functionalities and improve its services, which enables Bank of

Communications can

calmly respond to the development changes of the market and technology in the future.

Delivered Business Systems

Core banking system

Deposit

Loan

Payment & clearing

Foreign exchange

Electronic letter of guarantee

Uniform standardized customer information management

Digital banking system

Digital loan services

Unified payment platform

Open banking services (unified authentication of payment and collection, smart

ransportation, medical, courts,

government services, etc.)

Digital RMB

E-KYC (real-name authentication, four-factor authentication, online verification)

Blockchain Applications

E-channel system

Personal Internet Banking

Corporate Internet Banking

Mobile Banking

WeChat Banking

Host-to-Host

Self-service

Brokage business system

Government finance cash management

Budget management of government finance

Funds supervision (deposit guarantee, real estate transactions, prepaid consumption

funds)

Customs duty colletion business

Non-tax revenue collection business

Social insurance and medical insurance

Housing fund

Utility Payment

Other fee & commission

Big data service system

Aid in decision-making risk control

Credit reporting service

Expand loan business services

Customs duty colletion business

Data marketing service

Big data analysis

Other big data applications

Excellent user experience, intelligent customer service, and diverse product customization to meet the

personalized

needs of customers in the digital age.

Significantly shorten the R&D cycle and time to market, respond to rapid market changes with ease, and

enhance

competitiveness.

With a customer-centric approach, we aim to build an automated and streamlined operation platform to

enhance the

effectiveness of digital operations and promote significant improvements in operational capabilities.

Reduce IT costs. Open architecture can significantly reduce technology investment and operation &

maintenance costs.

High scalability and adaptability ensure that the system can be quickly upgraded and flexibly expanded

in the future.

National data centralization with unified technical platform,all branch's

corporate and retail businesses are launched

in batches.

Thousands of business innovation, rapidly developing digital banking

services, such as mobile payments, real-time online

loans, open banking, etc.

Achieve digital transformation and comprehensively promote the digitization

of customer journeys. Support rich financial

service scenarios and provide open platform to connect diverse ecosystems.

Future Outlook

For over ten years, MuRong has been a key partner of the BOCOM, solidifying our strong relationship. Our

ongoing IT

solutions have provided a strong foundation for the BOCOM's future. As advancements in AI reshape the

financial

landscape, MuRong is actively researching and developing innovative intellgent solutions to empower the

BOCOM in this

transformative era.